An HM Revenue & Customs (HMRC) document is an official paper from the UK tax authority. It is used for many tax purposes. These include tax assessments, certificates of residence, and unpaid balance letters.You can often access it through HMRC online services. You may need to notarize an HMRC document if you plan to use it in another country. Notarization confirms it is authentic for foreign authorities. NotaryPublic24 offers a simple online way to notarize your HM Revenue & Customs (HMRC) documents fast. It saves you time and effort compared to traditional methods.

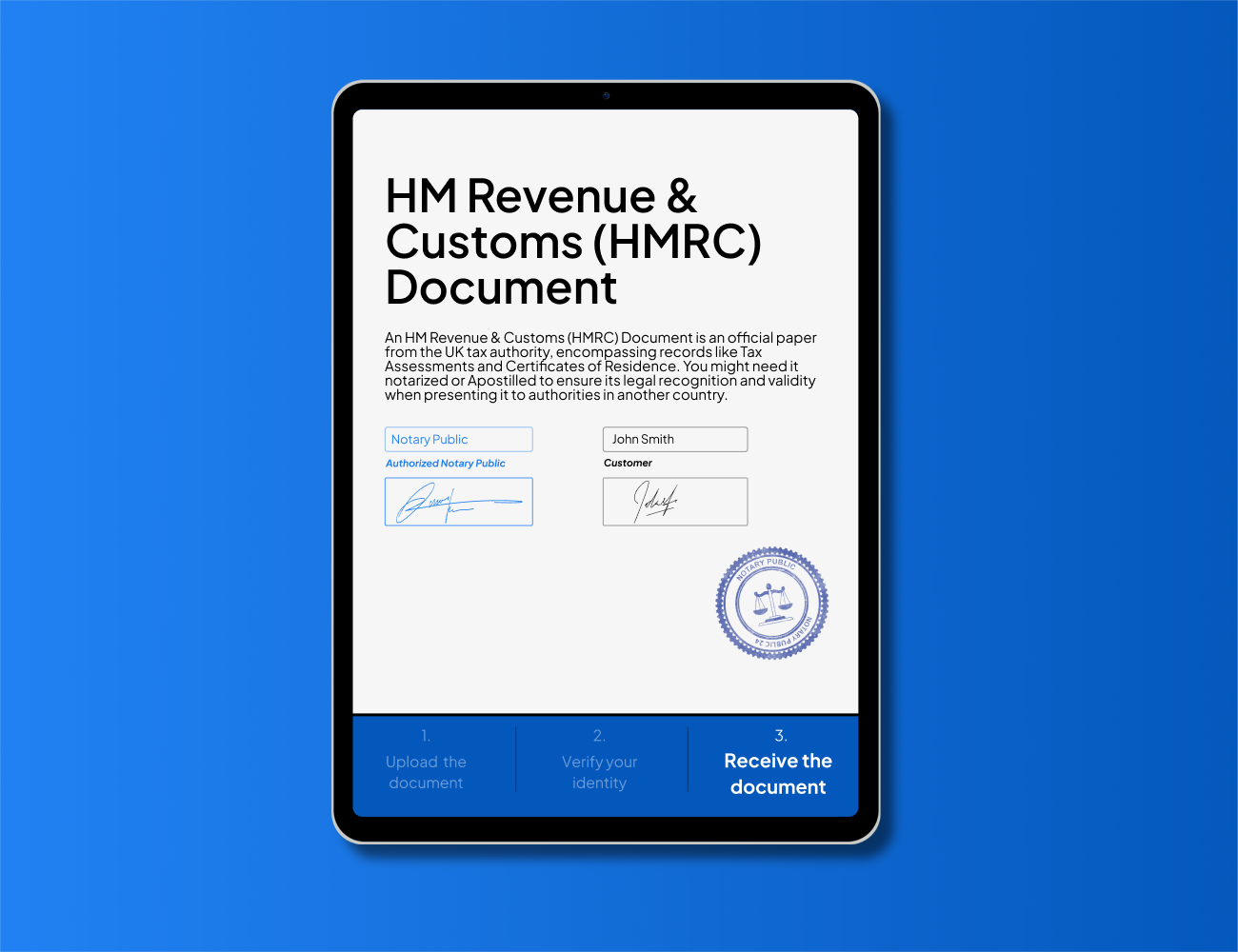

An HM Revenue & Customs (HMRC) Document is an official paper issued by the UK’s tax authority, HM Revenue & Customs (HMRC). These documents serve various purposes related to your tax obligations and status in the United Kingdom. They can include important information like your tax assessments, confirmation of your residency for tax purposes (Certificates of Residence), details of any outstanding tax (Unpaid Balance Letters), and other official tax-related statements. Essentially, an HMRC document acts as formal communication from the government regarding your financial dealings with them, ensuring legal compliance and providing necessary records for individuals and businesses.

These documents are crucial for proving your tax status, understanding your tax liabilities, and sometimes for international tax matters. The specific type of HM Revenue & Customs (HMRC) document you might need depends entirely on your individual or business circumstances. For example, a Certificate of Residence might be required when claiming tax relief in another country, while an Unpaid Balance Letter would outline any debts owed to hm revenue and customs hmrc. Many individuals and businesses now access hm revenue & customs hmrc online services to view and sometimes download these documents directly.

Having the correct HM Revenue & Customs (HMRC) document is vital for several reasons. Legally, these documents can serve as proof of your compliance with UK tax laws. For instance, a tax assessment confirms that your income and taxes have been reviewed and processed by hm revenue and customs hmrc. Some transactions or processes, in the UK or abroad, may require certain HMRC documents. These documents may include a Certificate of Residence. You may need them to claim benefits under double taxation agreements.

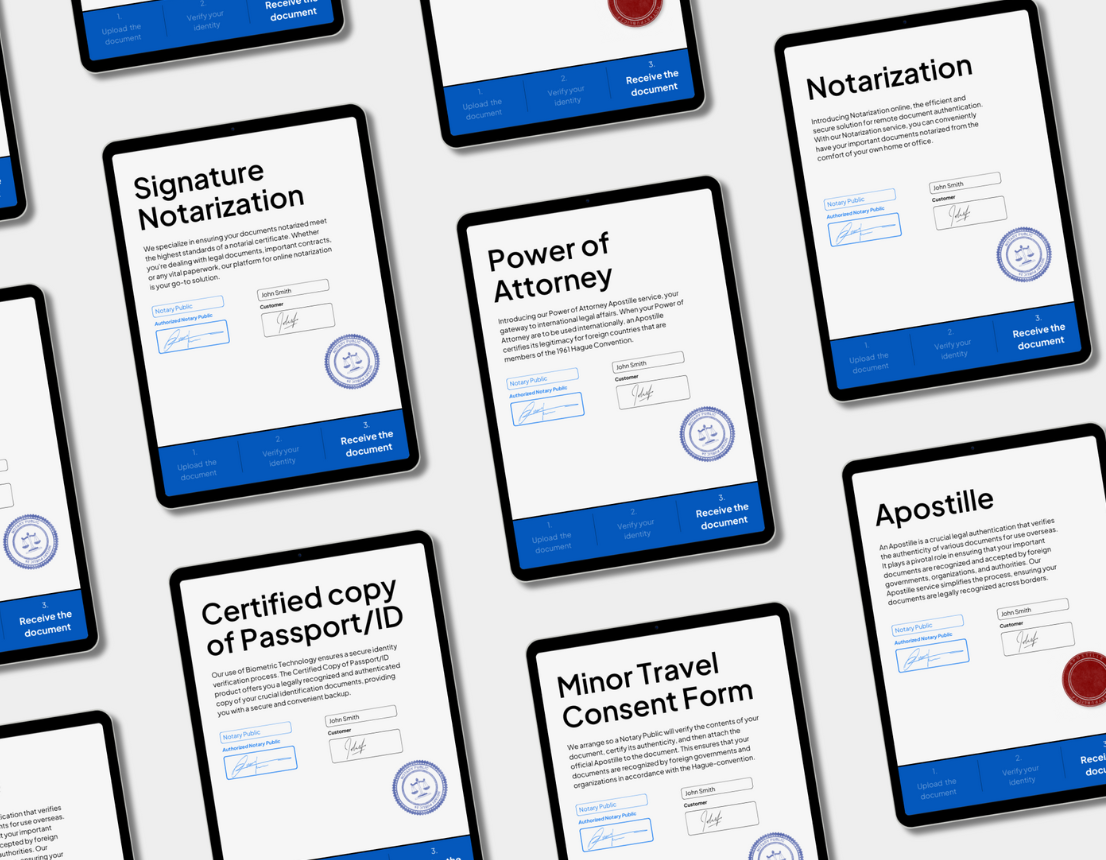

At NotaryPublic24, we understand the importance of these official papers. While we do not issue HM Revenue & Customs (HMRC) documents, we offer key services to help you use them. We can help, especially when you need them for international use. Our platform makes it easy to get important documents notarized or Apostilled for legal use abroad. This makes sure your Tax Assessments, Unpaid Balance Letters, and other tax statements have legal value. When you show them overseas, they will be legally recognized.

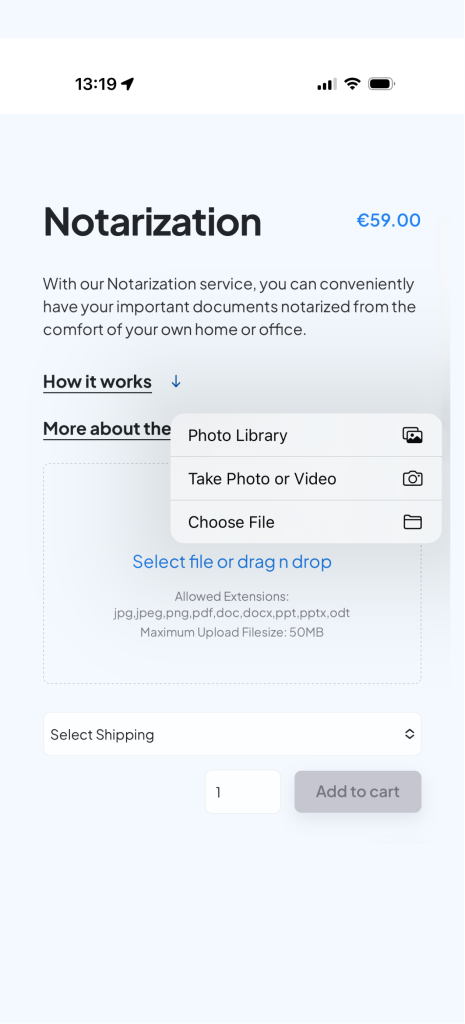

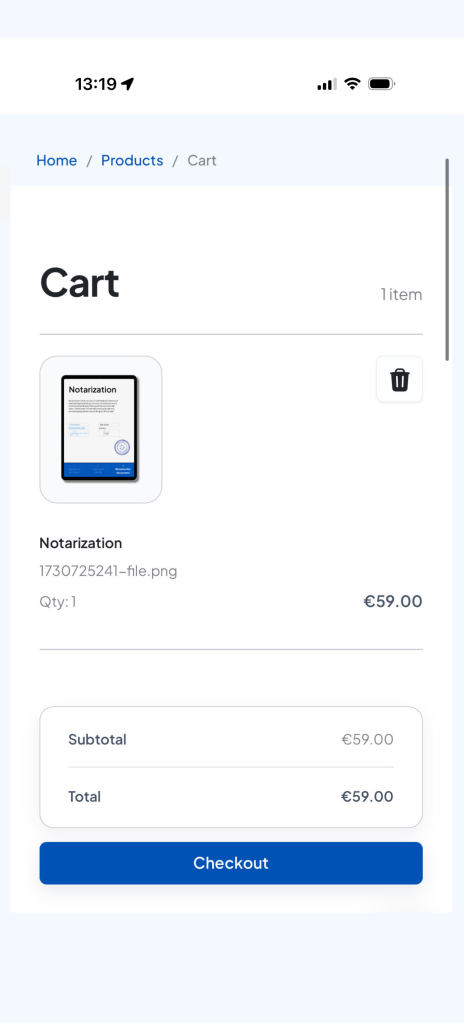

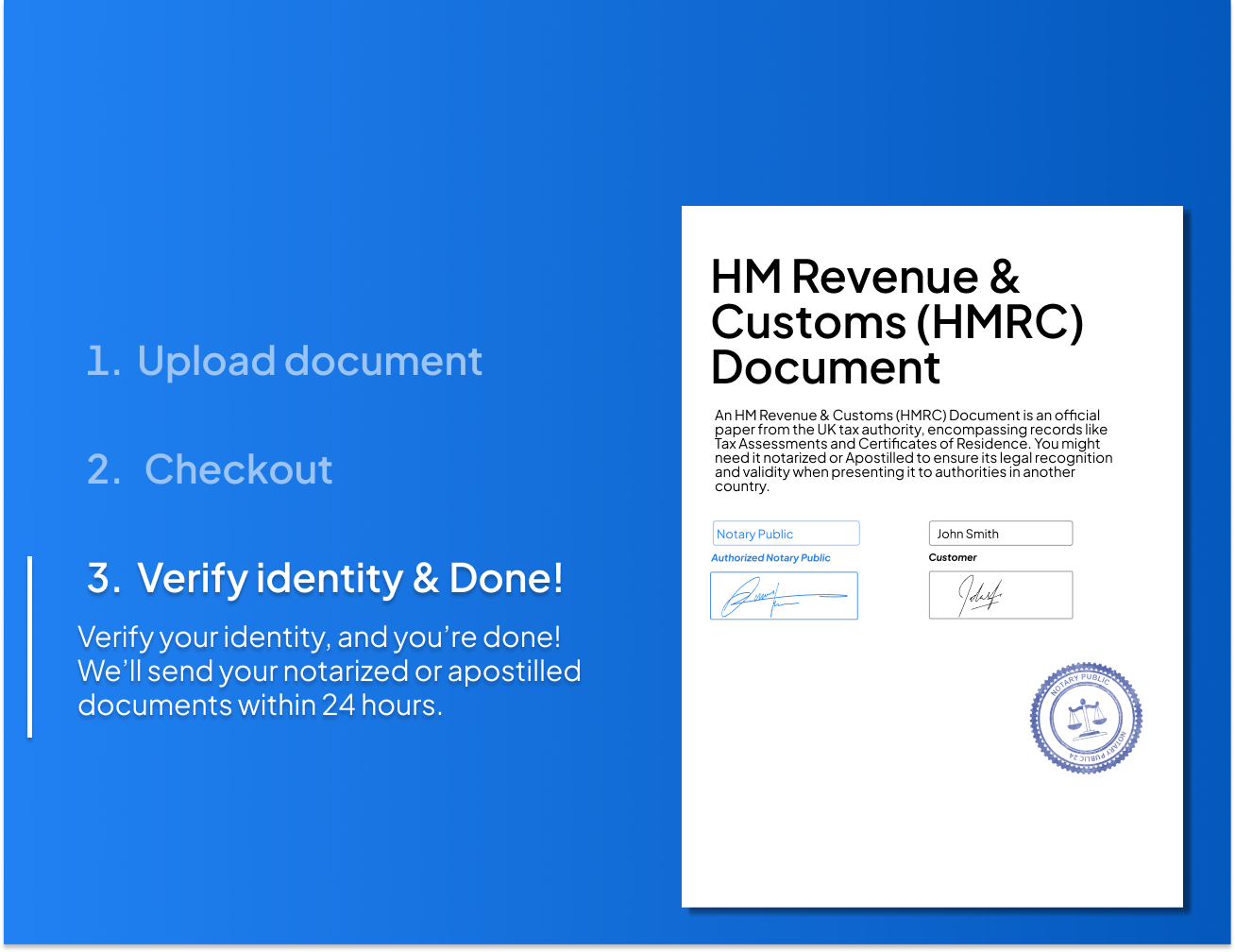

Certifying documents should be easy. Our process only takes a few minutes, and you will receive your certified documents within 24 hours.

Upload the documents you need notarized or apostilled.

Complete the checkout process, secure and efficient.

Verify your identity, and you're done! We'll send your notarized or apostilled documents within 24 hours.

Typically, you obtain an HM Revenue & Customs (HMRC) document directly from HMRC. Many documents are now accessible through their online portal, hm revenue & customs hmrc online services. You can usually log in to your personal or business tax account on the GOV.UK website – HMRC online services. Here, you may be able to view, download, or request specific documents like Tax Assessments or information regarding any Unpaid Balance Letters. For documents like Certificates of Residence, you might need to complete an online form or contact HMRC directly through their phone lines or postal address, as outlined on the GOV.UK website.

Sometimes, to be used in a foreign country, your HM Revenue & Customs (HMRC) document might need further legalisation, such as notarization or an Apostille. This confirms the authenticity of the document and the signature of the issuing officer. The requirement for notarization or an Apostille depends on the country where you intend to use the document.

You might need to get your HM Revenue & Customs (HMRC) document notarized or Apostilled if you intend to use it in another country. Notarization by a Notary Public confirms the authenticity of the document and the identity of the signatory. Following notarization, an apostille, issued by the UK Foreign, Commonwealth & Development Office (FCDO), provides further certification for use in countries that are signatories to the Hague Convention. This process assures foreign authorities that the HMRC document is genuine and legally valid in the UK.

NotaryPublic24 offers a simple and efficient solution for getting your HM Revenue & Customs (HMRC) documents notarized. Forget the hassle of finding a local notary and attending in person. With NotaryPublic24, you can simply upload your document, complete our straightforward checkout process, and quickly verify your identity by uploading a photo of your ID. The entire process takes just a few minutes, and we guarantee to provide your notarized documents within 24 hours. This is a significant advantage over traditional methods, saving you valuable time and money. Whether it’s a Certificate of Residence, a Tax Assessment, or Other tax-related statements, NotaryPublic24 streamlines the notarization process, making it easier than ever to get your documents ready for international use.

Looking for reliable Notary Public services? NotaryPublic24 provides a fully compliant notary service that adheres to all applicable laws and regulations. With our certified Notary Public professionals, we ensure efficient and secure document authentication. No matter if you are in the need of notarizing birth certificates, power of attorney, affidavits, a signature or any other documents – we will guide and help you throughout the whole process.

Uncertain about your possibilities? Contact us in a way that fits you the best, either by emailing us at “info@notarypublic24.com”, using our “Free Consulting” website form, or by chatting with one of our experts through the live chat application.

Notarization is the official process of having a document legally verified by a notary public. A notary public is an official who checks the identity of each person signing a document. The notary also confirms that each signature is real. This process makes the document legally valid and trusted. It helps prevent fraud and keeps it valid. This matters for buying a house, signing a contract, or making a will.

An Apostille is a certificate that makes your document valid in other countries. It’s like a stamp of approval that proves your document is real. It can be used in countries in the Apostille Convention. This agreement between countries makes it easier to use important documents abroad. It covers documents like birth certificates and marriage licenses. You do not need any other certifications. The Apostille verifies the signatures and seals on your document, ensuring it's accepted as genuine.

A Notary Public is an authorized official who has the right to issue certain certificates. An example is the Apostille stamp. A Notary Public is authorized by the state and applies their official seal and signature to certify the documents.

To obtain a Certificate of Residence from hm revenue and customs hmrc, you typically need to apply directly to HMRC. This often involves completing an online form available through the hm revenue & customs hmrc online services portal on the GOV.UK website. You may need to provide information about your tax affairs and the reason for needing the certificate. Once issued, if you need to use this HM Revenue & Customs (HMRC) document abroad, NotaryPublic24 offers a quick and easy online notarization service. You can simply upload your Certificate of Residence to our platform and complete the process in minutes, saving you the time of finding a traditional notary.

You can usually find your Tax Assessment online by logging into your personal or business tax account through the hm revenue & customs hmrc online services portal on the GOV.UK website. Once logged in, navigate to the relevant section, which might be labeled "Self Assessment," "PAYE," or similar, depending on the type of tax assessment you are looking for. Here, you should be able to view and often download copies of your Tax Assessments. If you require a notarized copy of your HM Revenue & Customs (HMRC) document for use in another country, NotaryPublic24 provides a convenient online solution. Just upload the downloaded Tax Assessment, and we'll handle the notarization efficiently.

An Unpaid Balance Letter from HM Revenue & Customs (HMRC) is an official document that details any outstanding tax liabilities you have with HMRC. You can typically request this letter by contacting HMRC directly through their online services, by phone, or by post. The specific method for requesting an Unpaid Balance Letter may vary, so it's best to check the GOV.UK website for the most up-to-date guidance. If you need to present this HM Revenue & Customs (HMRC) document to authorities in another country, NotaryPublic24 offers a streamlined online notarization service. Simply upload the Unpaid Balance Letter, complete our quick process, and get your notarized document without the need for in-person appointments.

You might need to notarize your HM Revenue & Customs (HMRC) document if you intend to use it in a foreign country. Notarization by a Notary Public confirms the authenticity of the document and the identity of the signatory, making it more likely to be accepted by overseas authorities, such as when dealing with international tax matters or legal proceedings abroad. For example, a notarized Certificate of Residence or Tax Assessment might be required. NotaryPublic24 offers a simple and fast way to get your HM Revenue & Customs (HMRC) documents notarized online. Just upload your document, complete the easy steps, and receive your notarized document, saving you considerable time and effort compared to traditional notary services.

While hm revenue & customs hmrc online services provide access to many tax-related statements, the availability of specific documents may vary depending on your tax situation and history. You can usually find key documents like Tax Assessments, payment records, and potentially information related to Unpaid Balance Letters through your online account. For other specific tax-related statements, you might need to make a direct request to HMRC. If any of these HM Revenue & Customs (HMRC) documents require notarization for international use, NotaryPublic24 offers a convenient online service. You can upload your documents and get them notarized quickly and efficiently, all from the comfort of your own home or office.

Yes, you can notarize your documents online. With our online service, simply upload your documents, complete the checkout process, and verify your identity digitally. It only takes a few minutes! You'll receive your notarized documents within 24 hours with a sealed notary stamp.

No, you do not have to be physically present to notarize online. However, you need to verify your identity with a government issued ID.